01 Apr Meet The King of Memphis

California Real Estate Investor Jeff King Struck Gold When he Came to Memphis

Jeff King struck gold in Memphis. The former U.S. Marine is stylish and well-dressed, with dark hair and a soul patch, and he comes across as suave, confident, and likable. The California King is also one of Memphis’ newest — and perhaps unlikeliest — real estate moguls. With Meridian, King’s 10-year-old family of companies, he has found undeniable success within Memphis, and the developer has made an impact in the local residential market while gaining little to no public attention. This year, Meridian will manage about 700 single-family and multifamily rental residences, and it will also sell about 100 area homes it either built or redeveloped. In 2018, King anticipates those numbers to grow, as he breaks ground on two new apartment complexes in the Mid-South. King only moved to Memphis two years ago, after managing his growing company from afar. He’s confident the Bluff City has the best rental real estate market in the country, and his impact on it seems destined to grow.

Jeff King struck gold in Memphis. The former U.S. Marine is stylish and well-dressed, with dark hair and a soul patch, and he comes across as suave, confident, and likable. The California King is also one of Memphis’ newest — and perhaps unlikeliest — real estate moguls. With Meridian, King’s 10-year-old family of companies, he has found undeniable success within Memphis, and the developer has made an impact in the local residential market while gaining little to no public attention. This year, Meridian will manage about 700 single-family and multifamily rental residences, and it will also sell about 100 area homes it either built or redeveloped. In 2018, King anticipates those numbers to grow, as he breaks ground on two new apartment complexes in the Mid-South. King only moved to Memphis two years ago, after managing his growing company from afar. He’s confident the Bluff City has the best rental real estate market in the country, and his impact on it seems destined to grow.

BUILDING CASTLES

In 2005, King and his Meridian co-owner, Kevin Conlon, were helping run Palomar Technologies, a spinoff of Hughes Aircraft Co. that had operations in California, Germany, and Singapore. The company was enduring the tough tech market of the early 2000s, but King felt drawn to leave the sector behind for the then-booming world of real estate.

King lived in California and began studying the industry and even hired a real estate coach. But, it was in August 2005 — as Hurricane Katrina hit — that a light bulb went off.

A self-described opportunist, King realized there would likely be great real estate investment opportunities in areas affected by the storm. He became fascinated by the Gulf Opportunity Zone, a robust federal program to encourage real estate investment in the Gulf states after Hurricane Katrina. King was initially drawn to Jackson, Mississippi, because it was the least damaged area within the Opportunity Zone, and a lot of people from the more damaged Gulf cities moved there.

“I thought, I’m going to go over to Mississippi and check that out,” King said. “I bought a whole bunch of these great rental homes … with essentially no money down.”

King bought his first houses in Jackson in 2007. He renovated them, found tenants for them and then sold them.

Jeff King analyzed more than 300 metropolitan statistical areas, looking for the best markets to flip single-family homes. The data pointed him to Memphis.

Within six months, Conlon decided to become an equal partner in the endeavor. Friends and family back in California quickly realized the wisdom of what the pair was doing and wanted in, too.

“The stock market was going all over the place,” King said. “We had an 8 plus percent return … with far more consistency than the market.”

Meridian generated about $2 million in revenue in its first two years. By the end of 2009, the company had outgrown Jackson and the need to be based in the Opportunity Zone. King and Conlon decided to move north, to Memphis.

“[Originally], it was purely based on trying to find a way to retire early on rentals. It became a company because it worked so well,” King said. “I’ve had multiple occasions to slow down, but it just became so exciting.”

KEYS TO THE KINGDOM

As opportunists go, King considers himself a conservative one. He trusts data more than his gut, and he’s not going to take unnecessarily big risks. So, before deciding to take advantage of the Gulf Opportunity Zone — and before deciding to invest in Memphis — he looked at the data.

King analyzed more than 300 metropolitan statistical areas (MSAs), looking for the best markets in the country to flip single-family homes. The data pointed him to Memphis. “Memphis is the best place in the U.S. for rental real estate,” King said. He took three factors into account in his analysis, and Memphis excelled at all three.

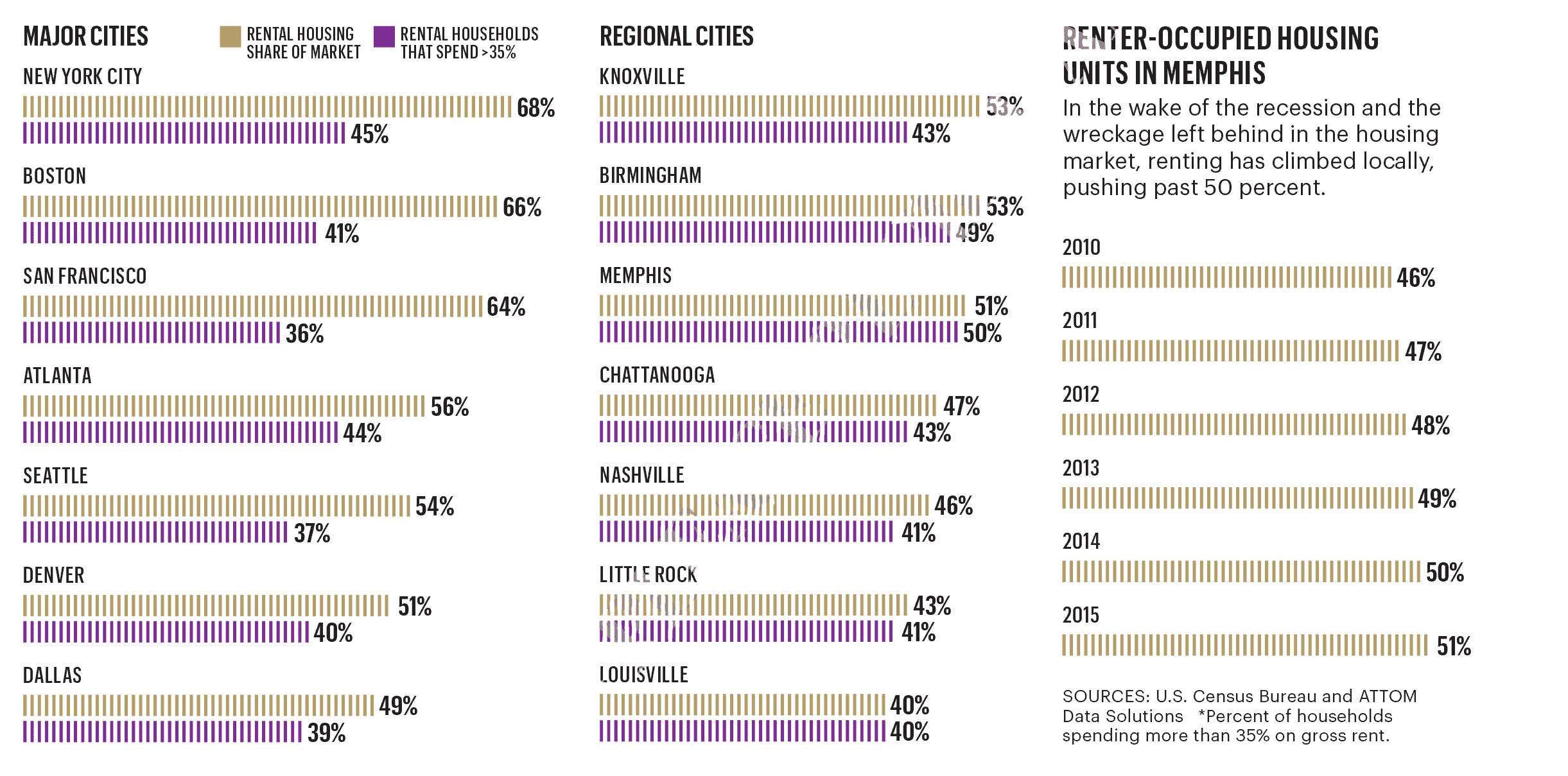

The first factor was maintenance costs, which are low in Memphis because of the city’s lack of snow, hurricanes and flooding. The second was the area’s regulations, which are friendly to landlords. The third was Memphis’ ultra-high rent ratio, meaning landlords can command a higher rent per the value of the house. Memphis’ rent ratio is high because of the demand for rental housing. About 50 percent of Memphis’ housing units are rentals, which is more than in most peer cities.

For comparison, about 46 percent of the housing units in Nashville and Chattanooga are renter-occupied. Little Rock is at 43 percent, while Birmingham and Knoxville come in around 53 percent. In some major cities, such as New York and Boston, the percentage of renter-occupied housing units is even higher — 68 and 66 percent, respectively — while other large cities, such as Portland and Dallas, clock in below 50 percent.

In June, RentRange, a housing market data provider, ranked Memphis’ MSA as having the No. 10 highest average gross yield in the country, at 13.9 percent.

Another advantage to working in Memphis, according to King, is that it’s not hard to guess where the city is going to grow. The Mississippi River prevents much expansion to the west, and there’s not a ton of opportunity to the south.

“It can only go north or east,” he said. “With the exception of some of the gentrification, that progress and growth continues.”

LIVING LIKE A KING

Meridian is active primarily in Bartlett, Arlington, Cordova, Southeast Memphis, and Olive Branch, though it does own some Midtown apartments — the exceptions to its overall suburban strategy.

“I focus on neighborhoods I would live in,” King said.

But, that wasn’t his original approach. King initially bought low-quality homes, renovating and then renting them out for about the market rate — the same approach many local residential real estate investors take.

But, he and Conlon realized maintenance costs on old houses were much higher than they’d expected. To combat this, the company began renovating houses in the $160,000 to $230,000 range and renting them for about $1,300 per month.

“We simply won’t play in the low- end market. Too many people sell these homes and run for the hills,” King said. “We take a lot of pride providing people opportunities to live in quality homes.” After switching to higher-quality renovations, King and Conlon added a property management division about five years ago so they could be more selective with the tenants they chose and have more control on the quality of the product they were selling to investors.

King said this decision was perhaps the best one he’s made at the firm’s helm. “I became really disenfranchised with local property management companies. I soon found doing it ourselves … gave us some control on how our investors fared,” King said. “Repeat buyers only come from people who have had a successful experience with us.”

In late 2013, King and Conlon decided to jump in on the front end of a growing national real estate trend (For more, see the sidebar, “New builds replacing flips,” on page 15.) They added new, “build-to-rent” homes to their company’s repertoire after recession-related foreclosures started dying down and vacant land became easier to find.

RENTAL TRENDS

NEW BUILDS REPLACING FLIPS

Memphis has long been a good market for investing in single-family rentals. The area has had landlord-friendly laws, low maintenance costs and a consistently high number of renters; all a typical rental developer had to do to be successful was buy cheap houses, invest a bit of money into them, rent them out and then sell them. But, that story is changing — at least in part.

There is a growing trend in the Memphis market of companies that once flipped homes building new houses instead. Since those houses will often last longer than a flipped home — and attract higher-income tenants — investors across the country are eating up properties.

Whether or not this is good for Memphis is disputed, but it’s certainly significant.

Like most new things, the trend of develop- ing new rental homes emerged out of a bit of necessity.

Because the economy has been consistently improving since the end of the Great Recession, there are fewer older or foreclosed homes available for purchase.

That has left companies such as Meridian, Memphis Invest and Memphis Investment Properties (MIP) — all of which grew quickly when a glut of cheap houses became available during and after the recession — lacking the inventory they needed to fully meet investors’ demand. So, real estate investment firms started filling their inventory with homes they built themselves on foreclosed lots.

“I like the idea of being able to create my own inventory,” MIP partner James Wachob said. “If I need 20 homes, I build 20 homes.

” Since 2015, the three companies have built or helped build about 360 homes in the Mem- phis region.

According to California-based ATTOM Data Solutions, 28 percent of the homes built in Mem- phis since 2015 are non-owner-occupied, which means they’re likely rental homes. That’s one of the highest percentages in the country for metro areas that had at least 1,000 houses built since 2015. Many of the cities with a higher percentage than Memphis are located in tourist-heavy areas — primarily on coastlines.

For comparison, only about 18 percent of homes built in Nashville since 2015 are non-owner-occupied.

“It’s good for our investors, who get to buy houses that have a brand-new roof and brand new systems. And it’s good for people who get to live in a brand-new home,” said Memphis Invest partner Brett Clothier.

But, is this new business good for the city? Doug Ryan, director of affordable homeownership at Washington, D.C.-based Prosperity Now — which works to help families achieve economic stability and mobility — has his doubts.

Local government could be doing more to spur homeownership as opposed to letting the free market lead the community toward more and more rentals, he said.

“Homeownership is still the biggest way for Americans to generate wealth,” Ryan said. “A city where about 50 percent of people rent should think, ‘How can we move the needle in the other direction?’”

Wachob, Clothier and Meridian co-owner Jeff King disagrees.

King, whose new homes rent for about $1,300 per month, said his rentals give people opportunities to live in nicer neighborhoods than they’d be able to afford otherwise.

“We take a lot of pride [in] being able to provide high-quality housing,” King said. “We’re bringing better demographics into the market and improving neighborhoods, [which is] improving the tax base.”

Wachob said MIP often restores the worst house or lot in a neighborhood, the properties that otherwise drive neighbors’ home values down.

“I’d say we’re helping neighborhoods by getting rid of blight,” Wachob said.

He is also proud of the wealth he’s able to help build for his out-of-state investors, giving them rent-producing assets to pass down to their children.

Meridian co-owner Kevin Conlon expressed a similar sentiment.

“We really change lives,” Conlon said. “Imagine how your life changes when you turn that $6,000 per month [retirement income] into $12,000 per month.”

RENT’S DUE: WHERE THAT RESONATES THE MOST

Given the population density in New York City and San Francisco, it is no surprise that renting is key in those cities for housing. Among its peer cities, Memphis is in the top half for residents who rent.

RENTER-OCCUPIED HOUSING UNITS IN MEMPHIS

In the wake of the recession and the wreckage left behind in the housing market, renting has climbed locally, pushing past 50 percent than vacant houses.

“We bought hundreds of foreclosed lots and land-banked them. We’ve been slowly building on them over the past four years,” King said.

Today, Meridian generally develops or redevelops a house, sells it to an investor and then gets paid to manage it by that investor. The company has about 200 buyers total, most of whom are high-net-worth Californians.

Meridian also hangs onto some of its houses and has redeveloped a handful of small apartment complexes.

This high-quality, multifaceted approach has been a roaring success. Meridian landed on the Inc. 5000 list of fastest-growing companies each year from 2012 until 2015, and it is set to generate about $20 million in revenue this year

HEIR APPARENT

As Meridian continues to grow, the company plans to invest in more commercial properties, including, for the first time, building its own apartment complexes.

King is hoping to break ground next year on a roughly 40-unit Olive Branch complex and a 30-unit complex in Cooper Young.

He considers his business built to last, no matter what the economy does. As recessions and downturns impact homebuying more than renting, King said, Meridian is already shielded from some economic fluctuation. And, with the company’s many business lines and data-driven approach, he is confident in future growth.

“We have a business, in a sense, for every market cycle,” King said. “People are always looking for good investments. … People always rent.”

Since times are good right now, King said his companies are working on the homes and land they’ve purchased in the past four years — “eating the bread we stored.”

If and when there is another recession, King said he will simply start buying more cheap properties to develop when times are good again. He wants Meridian to reign for a long time.

Please reach out to our team, or Meridian Pacific Properties for more information